With absolutely free tax filing for low earners, TurboTax provided customers two channels for alternatives from accountant and tax preparer work for filing taxes, one with desktop software that connected to the Internet and the second a fully-online version that also filed electronically. The lawsuit will peer into Intuit’s security and encryption measures and will shed a light on its practices.įiled in 2015, a class action against Intuit, the maker of TurboTax, was filed against the company alleging that it allowed criminal and fraudulent tax returns to be filed in the name of its customers who expected automated advisor tax services. Intuit handles millions of users’ tax returns every year and also offers other business software such as Quickbooks and online Payroll software for small business. Turbotax claims that all users’ tax information and transmittance to their servers are completely encrypted to the highest degree of security. The appeal of the software to users is the fact that users don’t have to travel to a tax preparation business or consult with an accountant in doing their taxes, they can do the tax return from their own home. Turbotax is very popular during tax season with many users seeking out the best tax advice and proprietors use the software for small business and tax advisors. Two women in the Northern District of California filed the lawsuit due to cases of identity theft in relation to Turbotax.

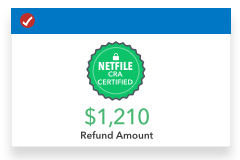

Turbotax is well-known for its free tax filing and best tax planning software and other specialized software. Intuit, the company behind one of the leading tax preparation services, Turbotax, is facing a class-action lawsuit.

0 kommentar(er)

0 kommentar(er)